Illustrated by Xinjia Liu

As early as 2010 when Alex Rampell first proposed the term O2O (Online-to-Offline), nobody predicted the rocket-fast development of O2O commerce in China over the following decade.

Today, with many offline brands getting online with an aim to share a slice of the big cake that is the e-commerce industry, people realize O2O also means offline to online. It works both ways, which means you could win a bigger slice if you master the skills and techniques behind this commerce trend.

The embrace of the Internet nowadays has put the coffee industry in China on a fast track of business development. Consumers are not only surrounded by plenty of innovative products but are also able to experience coffee in new ways, both online and offline. The coming together of the two sides of the coin has achieved an unexpected business scale-up in China, fostering not just hot start-ups with great potential but a growing domestic demand for specialty coffee.

Illustrated by Xinjia Liu

The Big Market

‘A booming scene’ has been widely used to describe the development of the coffee industry in China in the past years. According to data on statista.com, the revenue in coffee will reach US$9,307 million in 2020 as the coffee market in China is expected to grow annually by 10.7 per cent (2020-2023). “Coffee is a daily drink in many countries. In some countries, people consume around 200 cups per capita a year,” shared Will Tu, food merchant operation adviser of Tmall[1] Business, Alibaba Group, “But that’s more than 50 times of that in China.” The market is huge for China, much bigger than most people could imagine.

As a report by CBINSIGHTS shows, investors poured nearly US$600 million into coffee start-ups by July 2018, which was more than four times all funding in 2017. That July, luckin coffee raised a total of US$200 million for its Round A, making it the first Chinese coffee brand unicorn.

Illustrated by Xinjia Liu

The number of coffee shops has surged in the last three years thanks to the super quick expansion of Chinese coffee brands like Coffee Box and luckin coffee. The Xiamen-based luckin coffee got listed on NASDAQ on May 17, 2019, just 18 months after its establishment. Its store number has reached 4,507 across China, which was announced earlier this month during a launch event for luckin coffee EXPRESS and luckin popMINI in Beijing. This means luckin coffee has about 400 more stores than Starbucks in the country.

“Many Chinese consumers haven’t known much about coffee yet. It’s a long process of education to both the market and consumers,” Tu pointed out. The education he refers to includes a series of projects which have been initiated by Tmall — step by step, from seed to cup, from origins to customers — to deploy advanced technologies and the comprehensive platform of Tmall for a wide range of online and offline coffee brands to grow and shine.

Diversity of Innovation

In 2019 alone, start-up Saturnbird Coffee completed its Pre-A, Round A and Round A+ funding. Known for its signature high quality ground coffee, the brand has captured not only instant fame but also loyal customers. Established in 2015 in Changsha, Hunan Province, Saturnbird targets the mass market with a lucrative price (around US$1.2 per serving). The innovative quality instant coffee grounds using arabica beans can melt even in chilled milk/water in just three seconds. Furthermore, the miniature packaging cups in bright colors make the brand smart and social-media friendly.

“Coffee is about experience,” Tu said. “Consumers need an immersive experience when shopping for coffee online.” As he reveals, most instant coffee brands online hadn’t changed their packaging for five to 10 years before Saturnbird showed up. Apart from cute packaging, its homepage on Tmall is always well-designed based on a seasonal theme. “Consumers are not satisfied with out-dated packaged coffee. They were waiting for something new to come online while they grabbed a coffee from Starbucks or luckin,” Tu continued, “When Saturnbird arrived, they found such packaging design is just great for photos and sharing on social media.”

Illustrated by Xinjia Liu

By working with loyal customers and KOLs (key opinion leaders) online, Saturnbird has found its own methods in product innovation and development. “It opened its flagship store on Tmall in August, 2018,” Tu said. During the Double 11 Shopping Festival[2] last year, Saturnbird surpassed its rival Nescafé in sales revenue and became No.1 in the coffee category.

“Either its Project Return or Space Traveller Project is very inviting and intimate to consumers, which makes them feel as part of the brand,” Tu pointed out. The Project Return was initiated to encourage customers to help reuse or recycle used packaging jars. Space Traveller Project is a program that sees the brand get firsthand feedback on new products from ‘key customers’, either KOLs in general or local coffee champions. The latter not only helps the brand to improve before official launches but also allows it to reach a wider range of targeted customers more easily.

As a Powerful Platform With a background of 13 years’ experience working in food industries, Tu believes in the importance of education. “Education online or offline is important equally,” Tu said. “It’s not a linear growth regarding the development of the coffee market. It requires knowledge. It may be a spiral growth or on a growth plateau for a while before reaching an explosive growth. But it is growing anyway.” The continuous growth of coffee in China also makes Tu and his team think about how to better serve and help start-ups and small brands to grow with the strong technologies backed by Alibaba Group.

Illustrated by Xinjia Liu

Origin Projects to Connect Both Ends Tmall introduced its coffee origin projects to help coffee farmers find ideal coffee roasteries three years ago. “In 2018, we worked with coffee producers from Brazil and Rwanda to connect them with domestic coffee brands for business and collaboration,” Tu introduced. “The mission is to make it possible for our consumers to drink the coffee from the origins directly and have a deeper understanding of coffee and its origin.”

Last year, the origin of the year was Yunnan. Tmall worked with both the local government in Yunnan and social coffee organizations to host an offline event in December, providing a face-to- face ‘business meeting’ for coffee farmers and coffee roasteries who own online stores on Tmall. “The coffee production in Brazil and a few origins is on the decline, which poses great opportunities to Yunnan,” he continued, “But we still have much room to improve skills and techniques in growing; our domestic brands are not strong enough… So Tmall is projected to help improve the coffee green bean quality and enhance branding awareness among coffee farmers and start-ups.” According to Tu, Tmall aims to breed 10 local coffee brands worth 10 million yuan or more and 100 valued at one million yuan or above in the next three years.

Illustrated by Xinjia Liu

Meanwhile, Tmall purchased 7,000 tons of green beans last month; it has also set up five farms for specialty coffee in Yunnan. “The coffee will be available online, which will be featured during big promotions on Tmall to help attract more consumers and public attention to Yunnan coffee.”

For example, collaborating with top live streamers like Viya, or Wei Ya, is used as a measure to help promote Yunnan coffee too. Viya sold 1.3 tons of coffee in only two seconds during her live stream in September 2019.

Tu also shared the plan to promote more coffee origin countries such as Jamaica, Ethiopia, or Kenya in the future. “Promoting Jamaica as an origin is because many people can’t tell the difference between Blue Mountain coffee and Blue Mountain flavored coffee.” A flagship store of JABLUM opened on Tmall. “As a platform, we will adopt practices such as professional certificates or examination reports for these products to get customers better informed.”

However, it is merely part of the whole story.

Illustrated by Xinjia Liu

Online ⇄Offline Supply Chains A healthy supply chain matters a lot for a brand’s development. To a coffee producer or brand, the same rule applies. When a coffee origin becomes more accessible, the consumer end is something that many brands work hard on in a bid to further promote their products, especially online.

Fresh Hema, a new retail arm under Alibaba, is known for its online and offline integration. As Tu revealed, the brand now serves as an offline portal for online coffee brands to reach a number of potential consumers. “The comprehensive business system within Alibaba allows us to help online coffee brands or traditional coffee giants like Nestlé to improve the supply chains, ‘locating’ the targeted potential customers,” Tu stressed.

If you pay attention to the domestic coffee market in China, you will find a series of new products and programs launched by Nestlé in the past years. It is a great example of embracing the New Retail as Nestlé was awarded for organization transformation at the Alibaba ONE Business Conference last month. Backed with strong Internet technologies, the 80-year-old brand manages to find its second or third curve of growth in China, a market that it has been in for over three decades. “By working with our Innovation Center, Nescafé released its Fruity Iced Coffee series last May,” said Tu. The new instant coffee, available in three flavors, is the first crossover product by Nestlé.

Furthermore, Nestlé also worked with AMap, a map service mobile application acquired by Alibaba in 2014, for an online campaign to target its potential customers for capsule coffee. “The idea was to find out those map users whose destinations are often cafes or coffee shops and push adverts about capsule coffee or machines from Nestlé to them,” introduced Tu. “The integration of online and offline marketing brings together both potential and target audiences for Nestlé. Tmall is more than a ‘supermarket-like’ platform online to sell products. We want to contribute to educating consumers about coffee and related knowledge together with the whole industry together, from one end to the other.” It turned out to be a successful campaign with a higher conversion rate compared to the online campaign during the same period of time.

In logistics and delivery, the in-depth collaboration with Cainiao, a delivery and logistics company owned by Alibaba, has enabled Nestlé to greatly enhance its inventory turnover, for example, improved by 40 per cent during the 2019 Double 11 Shopping Festival compared to a year earlier. “Once the inventory turnover speeds up, which brings down the whole operation costs quickly,” Tu concluded.

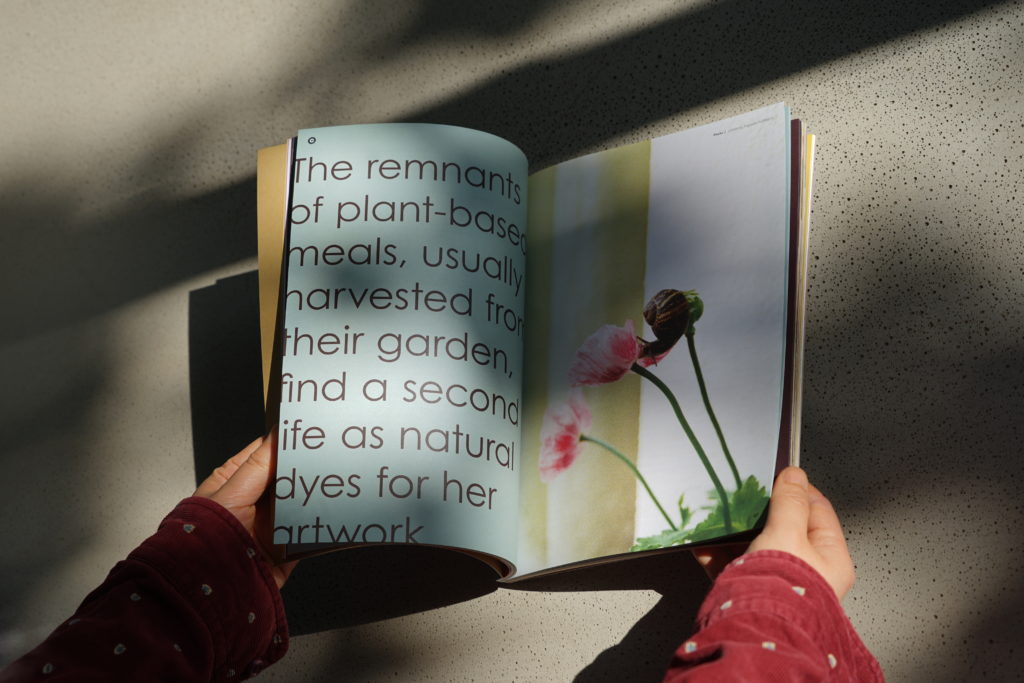

Knowledge is Power Some say, coffee is a subject of science. A good cup of coffee is the result of many people’s continuous effort. In collaboration with CBNData, Tmall last May published an insight report on China’s coffee consumption in 2019. “We published the report in 2018 and 2019 with an aim to show the public and coffee brands where the future market will be,” Tu stressed. “It’s about our responsibility to take the lead on industrial development in China.”

Apart from an in-depth insight into the domestic market, in a bid to breed potential start-ups, Tmall has provided comprehensive learning programs and tools to empower newly joined sellers. “A variety of online courses and feature posts such as how to use data to manage stores, how to attract more customers, will help them to quickly master skills and avoid foreseeable ‘traps’.” As Tu introduced, potential sellers will receive more help from the platform to gain more traffic online.

On December 19 and 26, Tmall held two full-day workshops in Baoshan, Yunnan Province to teach locals how to sell their coffee and products online. The offline training covered not only online operation but also packaging and design. “We hope this will help them raise the awareness of brands, say, Yunnan Coffee,” he shared. “Young entrepreneurs there should bear in mind how to market a product as well as get a sense of where the future is heading.”

In the next three years, Tmall’s goal is to foster 1,000 local coffee entrepreneurs in Yunnan.

Illustrated by Xinjia Liu

New Life for Offline Biz

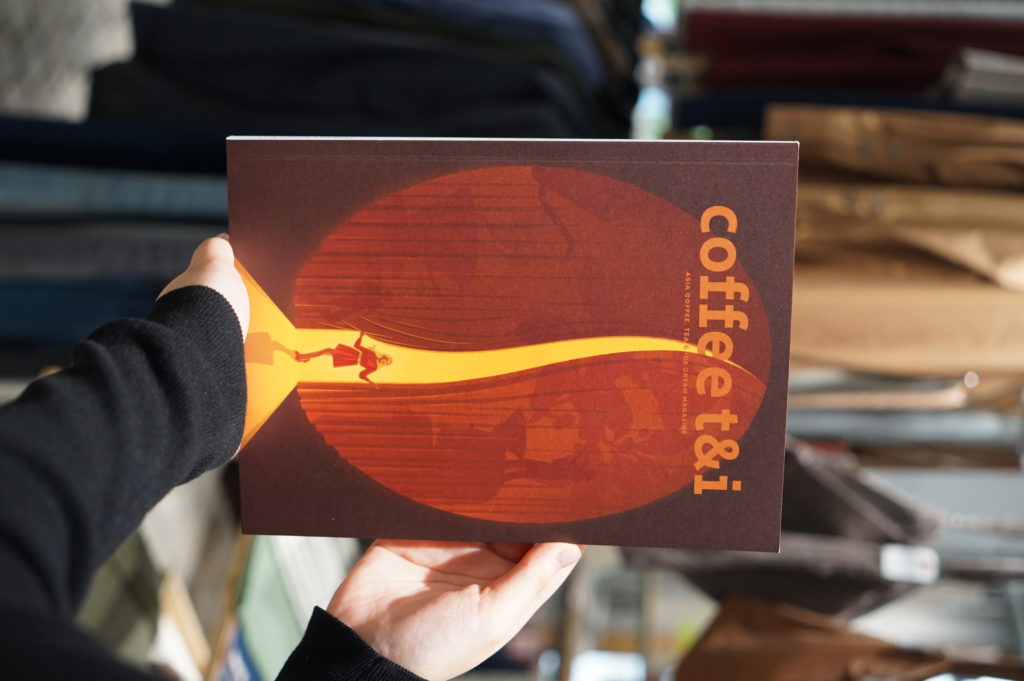

It’s an interesting trend that you find many brands opt to open offline stores once they achieve success online. Saturnbird Coffee opened its first bricks-and-mortar store in Changsha, Hunan Province. The brand also plans to open another in Shanghai this year.

Last August, Tmall Club opened its first coffee shop, collaborating with S. Engine Coffee, in Shanghai to promote coffee culture, which attracted many Tmall users and coffee enthusiasts. “Coffee is about experience. To consumers, they learn things and do shopping both online and offline,” Tu pointed out. “We serve as a ‘shelf’ that can provide good products online as well as a good shopping experience offline.” Tu believes that coffee shops can be a medium for consumers to learn more about coffee, from roasting, brewing to tasting. “We aim to achieve such an educational experience offline, showcasing how people can enjoy a daily life better.

For traditional instant coffee giant Nestlé, changes not only mean managing a better portfolio of products but also taking on challenges. In 2017, Nescafé launched its first pop-up store in Beijing, called Sense Cafe, working with renowned Japanese architect Shuhei Aoyama. The brand did another 7-day pop-up in a traditional local residence, also known as Siheyuan, in Beijing last year. The continuous effort has helped it to change its traditional brand image, which also brings more opportunities offline.

Illustrated by Xinjia Liu

Where There is a Way…

During the exclusive interview with CTI, Tu shared that Tmall’s plan is to better the online shopping experience for consumers via its mobile application. “We will further improve how people can shop for coffee on our mobile application. The app will better ‘understand’ the customer. The recommendation will be diversified based on the customer’s profile.” It means a newbie coffee drinker and a coffeeholic can see totally different products and posts.

Meanwhile, with plans to open coffee shops at universities such as Shanghai Fudan University and Xi’an Jiaotong Univeristy, Tmall wants the bricks-and-mortar cafes to pave the way to educate the next generation of coffee shoppers. Tu said, “It’s important to allow students to taste a proper coffee, especially when that may be their first cup.”

According to Tmall CBNData’s report on China’s coffee consumption in 2019, Gen Y and Gen Z have become the mainstream customer group in coffee consumption online, which amounts for nearly 70 per cent of the market. New products like coffee concentrate or instant soluble satisfy multiple needs for young people such as being easy-to-use, convenience, and the taste for a higher life quality. Also, as a coffee production country, China still has a long way to go for a higher position in trade. “We want to set this as a long-term goal. Coffee farmers still get paid little for their hard work. We will work with the authority and research agency to publish an official report on China’s coffee industry. Yunnan will surely be an important part of it.”

The tale of integration of online and offline in coffee is continuing in every corner of China. It may not be only in China but also in other regions. Will your story be part of the tale?

[1]Tmall, formerly known as Taobao Mall, is a B2C platform for local Chinese and international businesses to sell brand name goods to consumers in China. It is spun off from Taobao and operated by Alibaba Group.

[2]Double 11 (November 11) Shopping Festival, a.k.a. Singles’ Day Festival is a global shopping event initiated by Alibaba and adopted by other e-commerce platforms and retailers.

NO COMMENT