Page 36 - #77 eng

P. 36

C

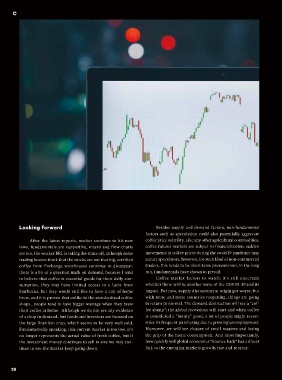

Looking forward Besides supply and demand factors, non-fundamental

factors such as speculation could also potentially aggravate

After the latest reports, market continue to hit new coffee price volatility. Like any other agricultural commodities,

lows, fundamentals are supportive, macro and flow charts coffee futures markets are subject to financialization. sudden

are not, the weaker BRL is taking the shine off, although some movements in coffee prices during the covid19 pandemic may

trading houses think that the stocks are not that big, certified attract speculators, however, for such kind of non-commercial

coffee from Exchange warehouses continue to disappear, traders, this tends to be short-term phenomenon, in the long

there is a bit of a question mark on demand, because I tend run, fundamentals have shown to prevail.

to believe that coffee is essential goods for their daily con- Coffee market factors to watch: it’s still uncertain

sumption, they may have limited access to a Latte from whether there will be another wave of the COVID-19 and its

Starbucks, but they would still like to have a cup of home impact. For now, supply disruptions at origin got worse, but

brew, and it is proven that unlike in the standardized coffee with more and more countries reopening, things are going

shops , people tend to have bigger wastage when they brew to return to normal. The demand destruction will see a “cof-

their coffee at home. Although we do not see any evidence fee slump”; the global recessions will start and when coffee

of a drop in demand, but funds and investors are focused on is considered a “luxury” good, a lot of people might recon-

the large Brazilian crop, which seems to be very well sold. sider its frequent purchasing due to growing unemployment.

Fundamentally speaking, this current market is too low, it’s Moreover, we will see closure of small roasters and losing

no longer represents the actual value of fresh coffee, but if the grip of the home consumption. And most importantly,

the investment money continues to sell in size we may con- how quickly will global economies “bounce back” has a direct

tinue to see the market keep going down. link to the emerging markets growth rate and returns.

international.lamarzoccohome.com

38